tax management services zimbabwe

In the Republic of Zimbabwe Deloitte operates as Deloitte Touche Zimbabwe. CS Professional Suite Integrated software and services for tax and accounting professionals.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

. Fast easy accurate payroll and tax so you save time and money. Topics of focus for tax authorities. Individuals who wish to claim exemption described below must present a copy of their diplomatic identification card andor their A-1 A-2 G-1 G-2 G-3 or G-4 visa when purchasing airline andor cruise tickets.

Fast easy accurate payroll and tax so you save time and money. Deductibility of certain expenses eg. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law.

Families in Zimbabwe Mozambique and Malawi are displaced and in need of food water and shelter. The presentation of a tax exemption card is not required to receive this benefit. Donate Now Zimbabwe has among the highest poverty rates in Africa according to a study in 201112.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. About Deloitte in Zimbabwe. Seigniorage derived from specie metal coins is a tax added to the total cost of a coin metal content and.

Take advantage of automated tools and outsourcing. Amendment to the definition of tax invoice and fiscal tax invoice. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance.

We can streamline your operations in a cost-effective manner by offering third-party Management Company ManCo services which can be complemented with fund administration middle office banking depositary and custody services all under one roof. Entertainment provisions management service fees allocated expenses from foreign related counterparts. Carol Stubbings Global Tax and Legal Services Leader Partner PwC UK argues that a new spirit of compromise is the key to fixing the global tax system.

Some issues that the tax authorities have focused on recently include. With trusted tax technology in place businesses can overcome these challenges and effectively manage sales and use tax to support growth. CS Professional Suite Integrated software and services for tax and accounting professionals.

Value Added Tax VAT is an indirect tax on consumption charged on the supply of taxable goods and services. Stay competitive in a constantly evolving asset management space. Deloitte Africa is a member of Deloitte Touche Tohmatsu Limited DTTL a.

Economic trends changing nexus regulations and increasing audit activity has made sales and use tax management a complex task with increasing risk. Deloitte Touche Zimbabwe is a part of Deloitte Africa. On 10 December 2021 the National Assembly of Zimbabwe approved the 2022 Budget.

We have summarised the key fiscal highlights from the 2022 Budget Statement the draft Finance Bill. Tropical Cyclone Idai made landfall with sustained winds of over 110 mph. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

Checkpoint Comprehensive research news insight productivity tools. Onvio A cloud-based tax and accounting software suite that offers real-time collaboration. This tax was introduced in 2004 to replace the former sales tax regime.

It is levied on transactions rather than directly on income or profit and is also levied on the importation of goods and services. America Uruguay Uzbekistan Venezuela Vietnam Zambia Zimbabwe eSwatiniSwaziland. Checkpoint Comprehensive research news insight productivity tools.

The correctness of tax incentive claims. Wealth management tax services. Section 2 and section 20 of the Zimbabwe VAT Act will be amended.

Seigniorage ˈ s eɪ n j ər ɪ dʒ also spelled seignorage or seigneurage from the Old French seigneuriage right of the lord seigneur to mint money is the difference between the value of money and the cost to produce and distribute itThe term can be applied in two ways. Catholic Relief Servicesalong with local partnersis working quickly to provide emergency support. Government imposes user charges to be.

Türkiye Uganda Ukraine Україна United Kingdom UK United States US USA US. Tax leaders should adopt the mindset of attendees at the 1944 Bretton Woods conference that gave us the postwar international monetary system. Onvio A cloud-based tax and accounting software suite that offers real-time collaboration.

Tax Planning Services For Uk Expats In Europe Blacktower Financial Management Eu

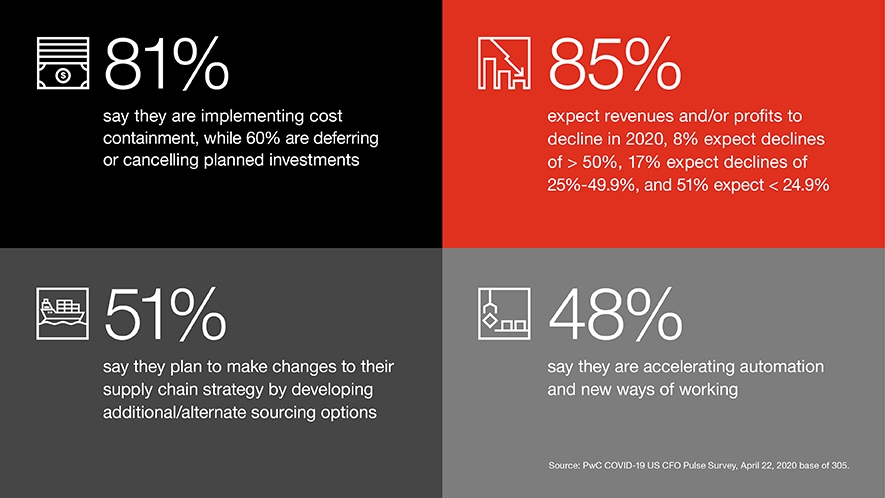

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Pwc S Approaches And Solutions For Overseas Business Pwc Japan Group

Onvio Firm Management Online Accounting Firm Management

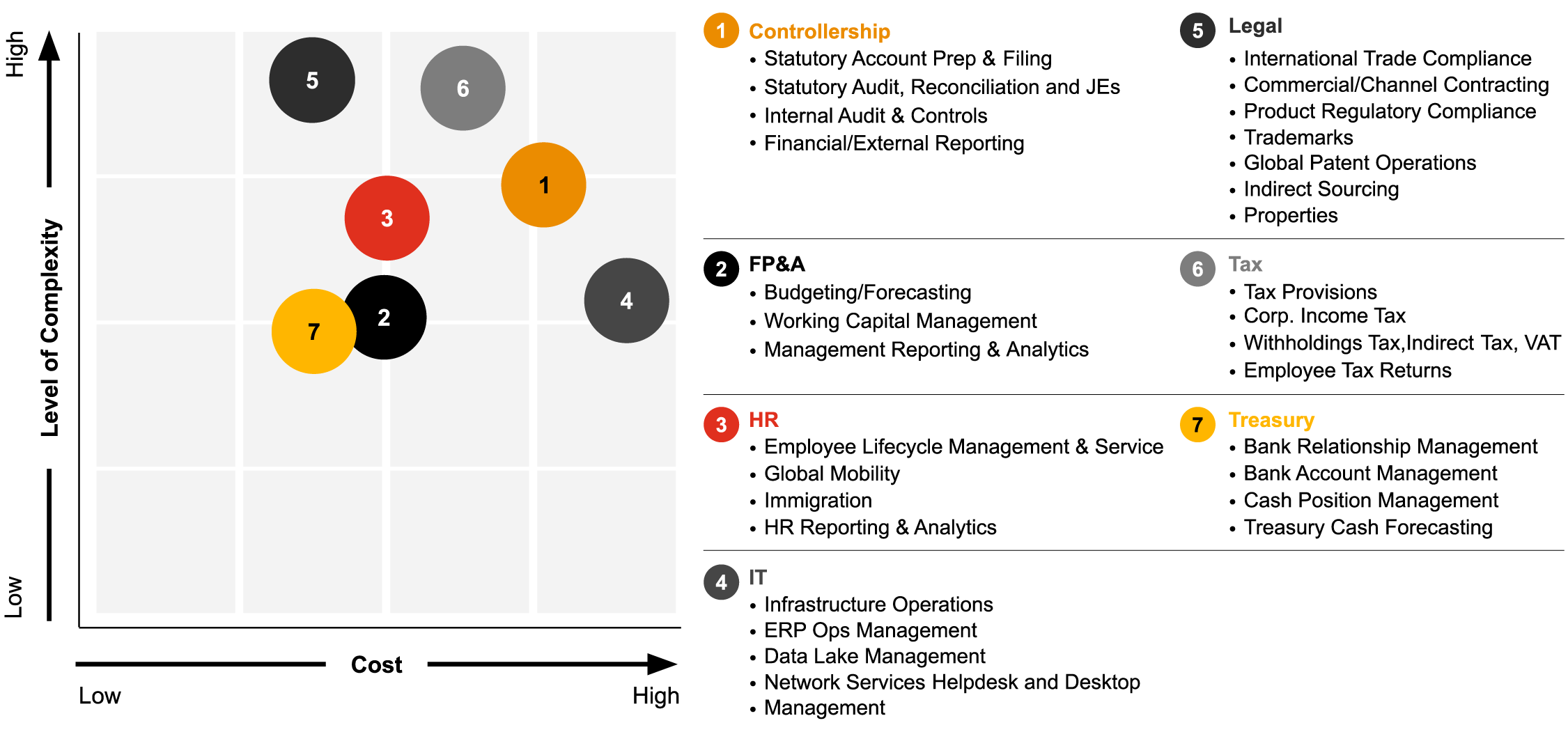

Capitalize On Tax Managed Services Pwc

Your Guide To Section 24 What Is Section 24 How To Manage It

Capitalize On Tax Managed Services Pwc

Digital Services Tax In Africa The Journey So Far

Tax Management And Accounting Services

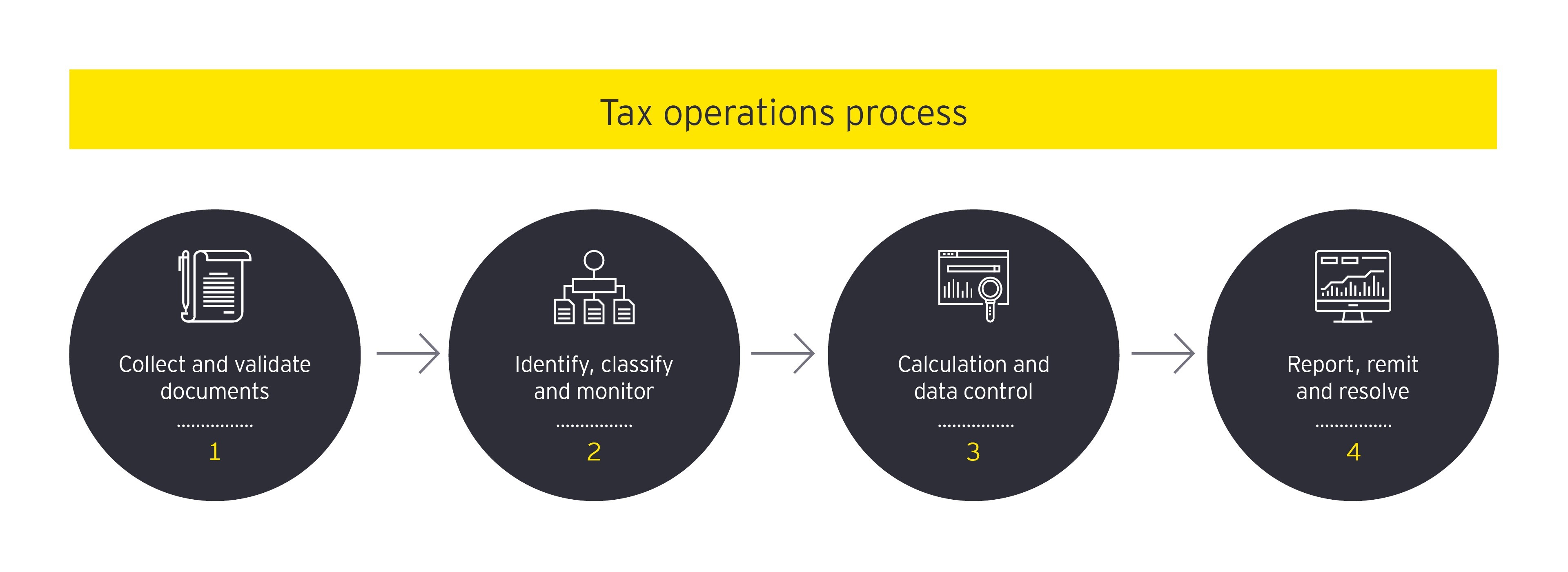

Customer Tax Operations And Reporting Services Ctors Ey Global

Pdf Effect Of E Tax Filing On Tax Compliance A Case Of Clients In Harare Zimbabwe

Kpmg Managed Services Kpmg Global

Mergers And Acquisitions Don T Forget The Vat Rsm Uk

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Advanced Aspects Of Service Tax Management Services Acca Global

Dentons Global Tax Guide To Doing Business In Zimbabwe